Singaporeans have always had a fascination for Real Estate properties. Yet, most investors only consider owning these properties as an individual. After all, that seems to be the most straightforward way. But what if there are better options that offer higher yield, such as incorporating a company? If you are puzzled on why, keep reading to find out the benefits of owning properties under a company as opposed to an individual.

1. Tenor

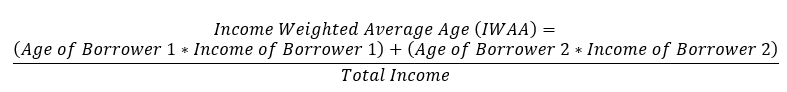

Under residential properties, Income Weighted Average Age, or IWAA, is the main basis of calculation for tenor length.

Under IWAA, age skews towards the person with higher income. This implies a lower loan tenor as the older person is typically the one with higher income.

if a father (with higher income) and son ask for a residential bank loan, it would mean that they would receive a shorter loan tenor.

On the other hand, purchasing commercial properties under a company is not restricted to IWAA as the bank typically recognises the youngest borrower. This means a longer loan tenor and a smaller monthly instalment. For investment properties that have rental yield, lower instalments are more affordable. If rental yield covers the instalments, Owners do not need to fork out their own money to repay monthly instalments.

Example

Harry wants to help his son Clinton to own a property and wishes to take a joint loan. If they were to take up a residential loan, the bank would consider the IWAA of both borrowers. The largest quantum available would be $560,000 at a loan tenor of 5 years.

In comparison, if they buy commercial property under company, the bank will base the loan tenor on the youngest person. This would mean that their largest loan would rise to $1.8 million with a 25 years loan tenor, making the monthly instalments much more affordable.

2. Loan To Value (LTV) Ratio

Loan To Value, otherwise known as LTV, is the ratio of loan the bank would allow you to take, based on the value of the property. For residential properties bought personally in Singapore, banks can only allow up to 75% LTV. In comparison, Commercial properties offer an LTV of up to 120% if bought under a company title.

One example would be purchasing a $2 million property. If the LTV of merely 75% is applied, it would mean a down payment of $500,000. On the other hand, using a 90% LTV would mean a down payment of $200,000. This means upfront costs can be minimized, and $300,000 can be saved to invest in other forms of investments with higher returns. This could also be appealing for Small Medium Enterprise (SME) that wish to expand their business but lack cash flow to do so.

While daunting to some due to the higher leverage, the scenario above illustrates how this could help to reduce the down payment significantly. This means that the value of properties that were once of your reach is now unlocked, which allows you to go for properties of higher value. Of course, this does not negate the dangers of over-leveraging and you should only take loans as much as you can afford. If you are unsure if this option is suited for you, it would be best to approach our mortgage brokers for personalised advice.

3. Asset and Liabilities

On the topic of liabilities, it is important to consider how we could make use of the various types of companies to maximise our leverage while ensuring we do not over leverage. One insider tip is to set up another company to ensure that you asset and liabilities are well-balanced and you do not over leverage.

If you are planning to be the one and only business owner, you should choose Sole Proprietorship (SP). This would also mean that you would be liable for all the debts and losses of the business. On the other hand, partnership is suitable when there are at least 2 business partners and the liability of the business is shared between the multiple owners.

4. Total Debt Servicing Ratio (TDSR)

If you have taken a loan before, the term Total Debt Servicing Ratio (TDSR) should be unfamiliar to you. TDSR restricts mortgage amounts by limiting mortgage instalments to only 55% of your income, in hopes of preventing investors from over levering.

Currently, the rate stands at 55% TDSR, and is applicable to both residential and commercial properties majority of the time.

To work around this, you could consider setting up a company to hold the properties.

Upon fulfilling certain conditions, the bank will treat as an operating company that is NOT considered as TDSR case. With a shell company, you can now maximise your leverage and own multiple properties with the same amount of money.

5. Legacy planning

In some cases, legacy planning (i.e. planning of the passing of oneŌĆÖs assets after passing on) would require the usage of shell companies.

If you have multiple properties to pass on, but do not have enough cash on hand to repay the outstanding mortgage and do not wish to subject your beneficiaries from having the mortgage liability, one option would be to set up a shell company and transfer the properties to the company. This could be a viable option for those who are asset rich but lack liquidity and have plans to include these properties in their legacy planning.

6. No additional cost

Another benefit of investing in commercial properties is the absence of additional costs. Unlike residential Buyer Stamp Duty that is 3% of purchase price, commercial buyer stamp duty under company is 0.2% of Net Asset Value, which could be significantly lower in monetary terms.

7. Cash Out

Cash Out is an option for owners who wish to monetize the property without selling the property itself. Otherwise known as equity loans, this is a viable option to get some liquidity for further investments or to pay for your childŌĆÖs university tuition fees. The benefit of doing so under a company instead of under an individual is that there is a significantly higher loan quantum under the company.

Example

Dora has 2 fully paid properties worth $3 million. As an individual, she would only be able to cash out $2 million dollars. However, if she shifted the assets under a shell company, she would be able to cash out $3,600,000. If Dora wishes to have more funds to expand her start-up, the latter would be a preferable option.

8. Order of Purchase

Another tip to go about owning multiple properties is to plan out your order of purchase. Suppose you have set your eyes on a commercial property and a residential property and wish to purchase both. Since you have limited cash on hand, you would like to maximize leverage to cover the costs of the property. Which property should you buy first to maximize your leverage?

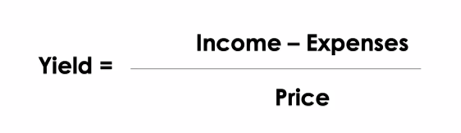

9. Yield

In order to get higher yield, you would need larger numerator or a lower denominator. The most effective way is to minimize your expenses. One way is to minimize the monthly instalments due.

10. Goods & Services Tax (GST)

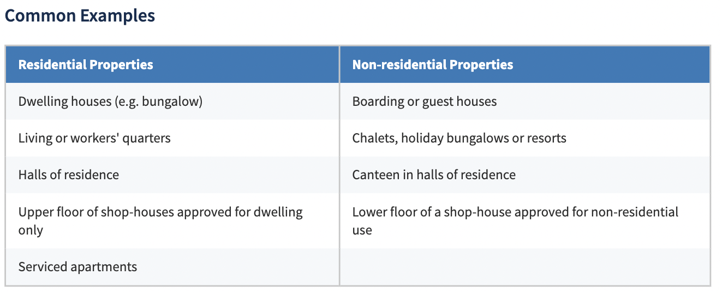

Although the current Goods & Services Tax (GST) stands at 7%, the state has suggested that there will be a hike in tax rates to 9%.

Since GST is payable for all non-residential properties bought from a GST-registered seller, individuals buying non-residential properties will have to absorb the 7% tax paid. On the other hand, if a company that is GST-registered purchases a property, it would be able to offset the GST paid with GST collected (e.g. from rental income of a retail property etc). This could add up to a hefty amount, as GST payable for a $1.8 million property would amount to $126,000.

Since taxes have been known to erode the yield of investment properties, purchasing under a company could be more viable in terms of maximising returns.

11. Income Tax

The last tip would be to make use of shell companies to create tax-savings. With the progressive tax system adopted in Singapore, your income tax would increase alongside your paycheck increases. To maximize tax savings beyond the well-known Central Provision Fund (CPF) Supplementary Retirement Scheme (SRS) hack, another tip would be to purchase your properties under a company instead.

Unlike income tax, corporate tax is fixed at 17% and is likely to stay, in order for Singapore to remain attractive to businesses across the globe.

Conclusion

While most of us have chosen to purchase properties as an individual, purchasing properties under company also has its perks. In fact, it could be more effective with extending loan tenors and offer investors better returns. We hope that this article has helped you identify the pros of purchasing commercial properties under a company. If you are still unsure on whether such methodology would be suitable for you, we would recommend speaking to one of our consultant┬Āadvisors for case-specific advice.